BlackRock expects bond ETFs to continue to grow, reaching $6 trillion in assets under management by 2030, up from just over $2 trillion today.

Tortoise rather than hare

It took 17 years, since the launch of the first bond ETF by BlackRock in 2002, for the market to reach $1,000 billion, but only three more years to double that to $2,000 billion in July last year.

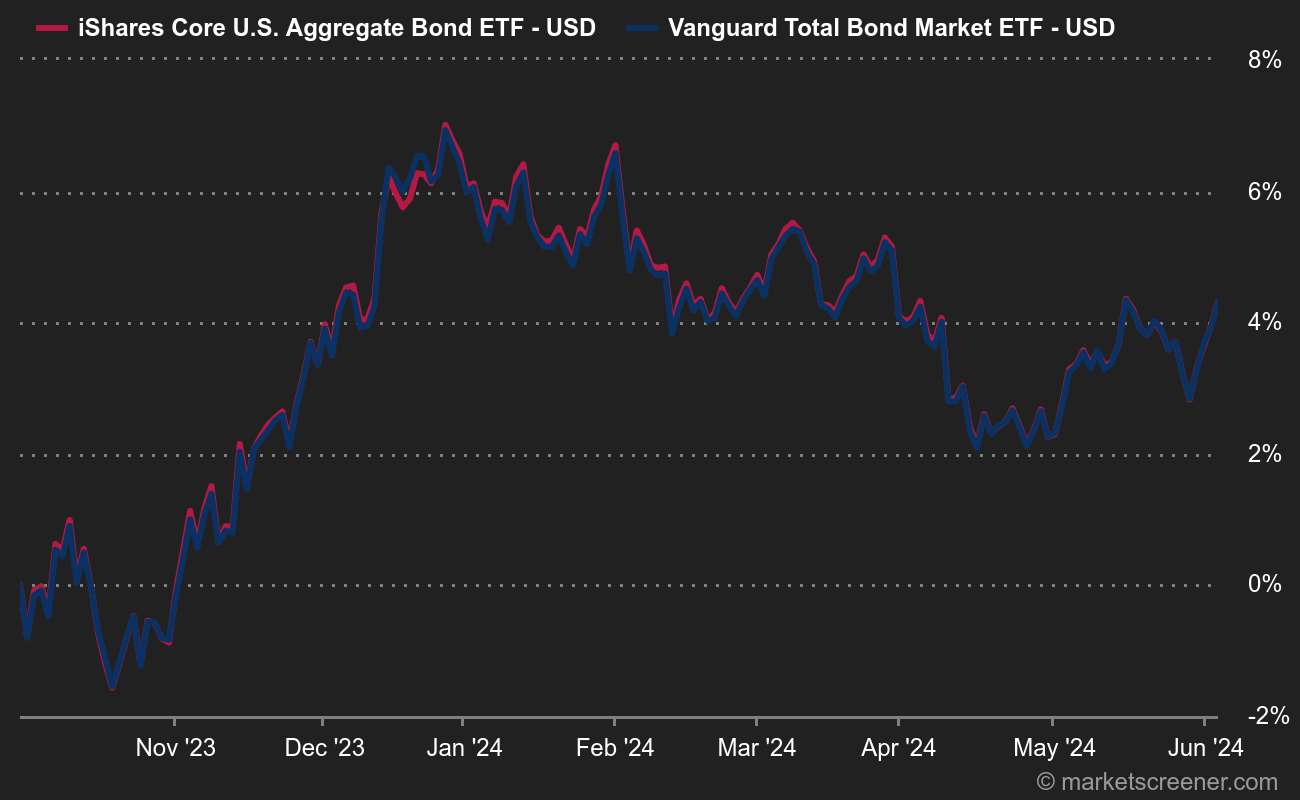

Bond yields surged in 2023, as central banks were forced to raise interest rates to counter inflation.

Bond ETFs have risen sharply in recent weeks

The data also show that traditional mutual funds have lost ground to ETFs in the bond market. In the US, fixed-income mutual funds peaked in November 2021 at $5,600 billion, before falling back to around $4,600 billion in the summer of 2023. Investors prefer ETFs, which are more flexible, cheaper and more liquid. BlackRock's largest bond fund, the iShares Core U.S. Aggregate Bond ETF (AGG), has passed the $100 billion mark in assets under management. Its fees are limited to 0.03%, like those of its main rival, the Vanguard Total Bond Market ETF.

By

By