As we move away from the market carnage of 2022 and enter what is expected to be another choppy year for equity markets, we explore the opportunities and risks associated with high-dividend equities as a source of portfolio income with three ETFs to put on your watchlist.

Relative outperformance on high dividend equity ETFs in 2022

High-dividend equity ETFs were one of the few outperformers last year, with the average ETF down between 3-6% compared to the broad S&P Index’s performance of -16%. This is not surprising considering the flight to safety resulting from the aggressive rate hiking cycle undertaken by Central Banks.

However, what is slightly surprising is the variance in performance among high-dividend equity ETFs, suggesting that sector allocation played a significant role in outperforming not just the broad markets, but their own benchmarks as well.

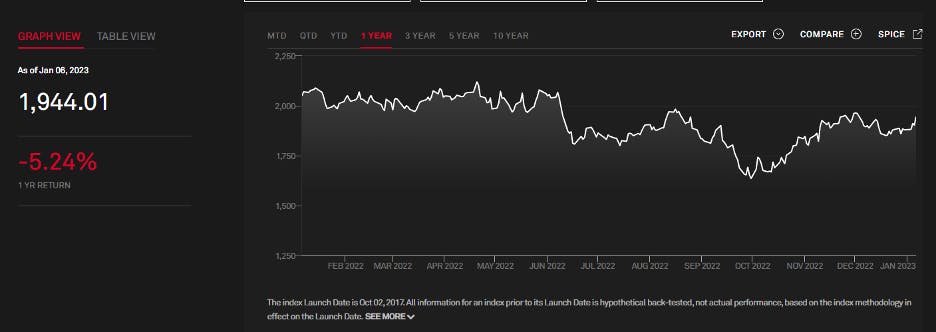

Here, we analyze three of the best-performing high-dividend equity ETFs in the last 12 months and discuss the risks and opportunities associated with them for 2023. Given that each of the ETFs below are individually designed to track different benchmarks, we will compare them to a common benchmark, the S&P500 Dividend and Free Cash Flow Yield Index:

Vanguard High Dividend Yield ETF (VYM)

The VYM ETF aims to track the performance of the FTSE High Dividend Yield Index. The index consists of common large and mid-cap stocks of U.S. companies, that are selected for their above-average high dividend yields over the last 12 months, excluding REITs.

The ETF is made up of 443 large cap/ value holdings, spread over ten sectors, the largest of which being Finance (20.20%), Healthcare (15%), and Consumer Staples (12.7%). Energy is its 4th largest allocation, at 10.6%, yet this sector has the potential to contribute a lot more to the income generated by the ETF in 2023, as cash flows to oil producers remain at record highs.

The ETF’s lowest allocations are to Basic Materials (3.9%), Communications (4.6%) and Technology (6.2%), which may help explain the relative outperformance to the overall market. Technology and Telecommunications were two of the hardest-hit sectors in 2022 and their underperformance could continue for the foreseeable future, as interest rates work their way through the economy.

VYM outperformed the S&P 500 Index by +12% over the last year and the S&P500 Dividend and Free Cash Flow Yield Index by 1.2%, while maintaining a low fee of 0.06% and diversification across multiple sectors.

Given its decent exposure to Energy, as well as the relatively low allocation to interest rate-sensitive sectors, investors looking for dividend income should watch this ETF carefully and consider its role in their portfolios for 2023.

iShares Asia Pacific Dividend UCITS ETF (IAPD)

For European Investors who are searching for a more globally diversified ETF that is able to provide

exposure to high dividend equities, IAPD could be of interest. The ETF tracks the performance of the S&P Asia Pacific Dividend Index and provides diversified exposure to dividend-generating companies in the Asia Pacific region.

The ETF’s current geographic allocation breakdown is focused on the most developed Asian Pacific nations, with +90% of its holdings focused on Japan, Australia, and Hong Kong (Japan: 33%, Australia: 32.2%, Hong Kong: 30.5%). The remaining balance is split between China and New Zealand at 3.5%.

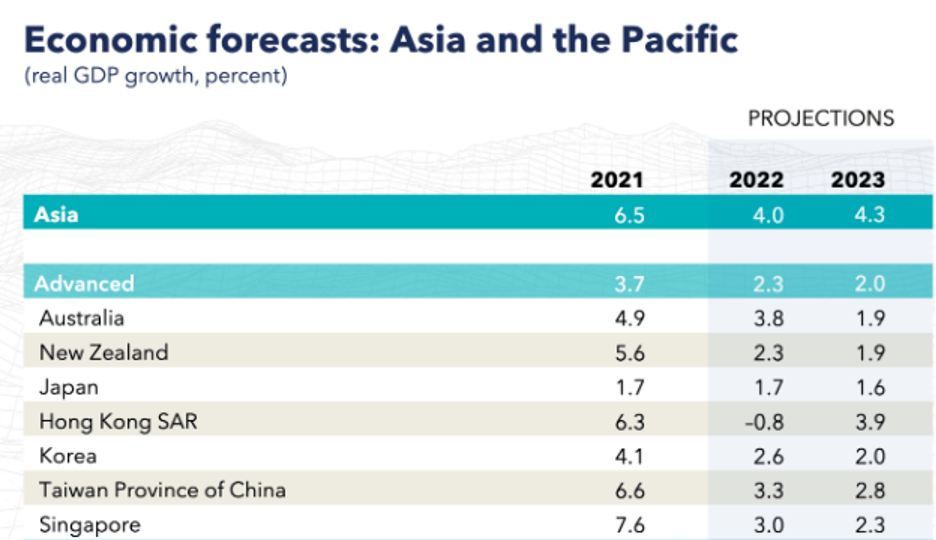

The geographic breakdown is important for the ETF’s ability to capture the growth potential in Asia, while at the same time avoiding the risks associated with developing nations. For 2023, Hong Kong is projected to grow at 3.9% as per IMF data, which makes up one-third of the ETF’s allocation. Similarly, Japanese and Australian economies are projected to grow at 1.6% and 1.9% respectively, which is a moderation when compared to historical growth rates.

The iShares Asia Pacific Dividend UCITS ETF has yielded close to 6.6% in dividends over the last 12 months, and its performance is off to a great start in 2023, with a 5.21% increase YTD, vs. the S&P500 Dividend and Free Cash Flow Yield Index at 1.98% YTD.

For European investors hungry for yield, and with a preference towards more global diversification, an allocation to IAPD could be a consideration in the months to come, especially if the news coming out of China continues to be positive.

WisdomTree Europe SmallCap Dividend UCITS ETF (DFE)

Europe has certainly seen better days, with inflation running in the 10% range, a war in Ukraine, and an energy crisis that has seen gas bills for some citizens rise as much as 200% since the beginning of 2022. The ECB has recently reiterated its commitment to bringing inflation down, and expects “a few more hikes,” as per Mario Centrano, the Governor of the Bank of Portugal.

Still, the risk of a continued aggressive hiking cycle has been dampened by recent slowdowns in inflation, a milder-than-expected winter resulting in moderating energy prices, as well as vastly different economic conditions in EU member states. This all makes the ECB’s job of applying a “cookie cutter” policy much more difficult than that of the FED.

For European investors looking to invest in companies closer to home, while benefiting from relatively high dividend yields - and what could be an improvement in economic conditions over the next few years - the WisdomTree Europe SmallCap Dividend UCITS ETF could be a good choice.

The ETF primarily invests in Small Cap companies throughout Europe, with its top three geographical allocations being the UK, Sweden and Germany. The heavy allocation to Industrials (27%) could prove potentially risky in the event that energy prices remain high and global demand slows down in 2023.

That being said, the ETF as a whole has yielded 4.95% over the last 12 months, and has a relatively cheap overall valuation, with a price-to-earnings (P/E) ratio of 8.15, and a price-to-book (P/B) ratio of 1.32. This is in comparison with the S&P500 Dividend and Free Cash Flow Yield Index, with a P/E of 10.87 and P/B of 1.91.

Please note this article is for information purposes only and does not in any way constitute investment advice. It is essential that you seek advice from a registered financial professional prior to making any investment decision.