Technavio has announced the top five leading vendors in their recentglobal UAV payload and subsystems market report. This research report also lists five other prominent vendors that are expected to impact the market during the forecast period.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170105006046/en/

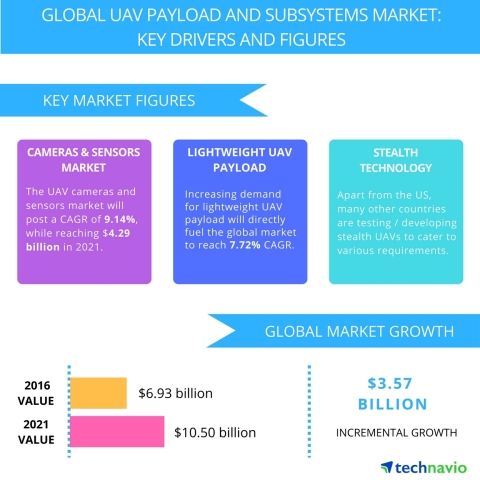

Technavio has published a new report on the global unmanned aerial vehicle payload and subsystems market from 2017-2021. (Graphic: Business Wire)

For over a decade, major spenders such as the US, Russia, China, and the UK have made significant investments in the development and procurement of next-generation UAV platforms to strengthen their security and surveillance capabilities. Also, the growing territorial disputes between countries have resulted in increased focus on maritime warfare, obligating naval agencies to enhance their target acquisition capability and acquire advanced UAVs and associated payloads and subsystems.

Competitive vendor landscape

The global UAV payload and subsystems market is highly competitive with many prominent players competing to enhance their market share. Also, due to the stringent safety and regulatory norms, along with the requirements for superior investments, entry of new vendors is expected to get restricted during the forecast period.

“Due to the rapid adoption of miniaturized UAVs in the surveillance applications, UAV components suppliers need to develop and supply cost-efficient and miniaturized payloads that can enhance the operation capability of small UAVs,” says Moutushi Saha, a lead defense research analyst from Technavio.

Companies with superior technical and financial resources can bring substantial changes in the existing payloads and subsystems, which will help them to recoup the development costs in shorter development cycle time. The smaller companies can establish collaborations to compete with existing prominent vendors.

Request a sample report: http://www.technavio.com/request-a-sample?report=55400

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Top five UAV payload and subsystems market vendors

AeroVironment

AeroVironment manufactures and markets UAVs, tactical missile systems, and associated services primarily to various organizations within US DoD, including the US Army, Marine Corps, Special Operations Command, and Air Force; as well as to allied armed forces. These UAVs are used to establish ISR superiority on the front lines of combat zones.

Boeing

Boeing, along with its subsidiary, INSITU, designs, manufactures, and supplies UAV and associated systems for its customers spread across the global defense industry. The company also offers field operations and logistics, training, flight demonstration, and payloads directorate services.

Elbit Systems

The company develops, manufactures, and supplies EO payloads for UAVs and support equipment for the global defense and homeland security industries. It has been enhancing its business through strategic acquisitions and establishing joint ventures (JV). In April 2016, Elbit Systems signed an agreement with an Indian technology provider, Adani Aero Defence, to establish a JV for co-operating on UAVs development in India.

Lockheed Martin

The company engages in the development of advanced surveillance and imaging technologies that are used in remote sensing, EW, and maritime surveillance operations. It also offers systems support, maintenance, and training services covering a comprehensive array of UAV platforms. Lockheed Martin also manufactures and supplies hand-launched small UAV platforms along with man-portable GCS.

Northrop Grumman

Northrop Grumman develops both surveillance and attack-enabled UAVs for the US and NATO allied countries globally. In October 2015, the company secured a contract worth USD 3.2 billion from the US Air Force to initiate upgrades for the RQ-4 Global Hawk fleets for next 10 years. The RQ-4 Global Hawk UAV allows broad-area surveillance by employing high-resolution SAR and long-range IR sensors.

Browse Related Reports:

- Global Unmanned Aerial Vehicle Battery Market 2016-2020

- Global UAV Market 2016-2020

- GLOBAL UAV PAYLOAD AND SUBSYSTEMS MARKET: RESEARCH REPORT 2015-2019

Become aTechnavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like aerospace, general aviation, and homeland security. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170105006046/en/