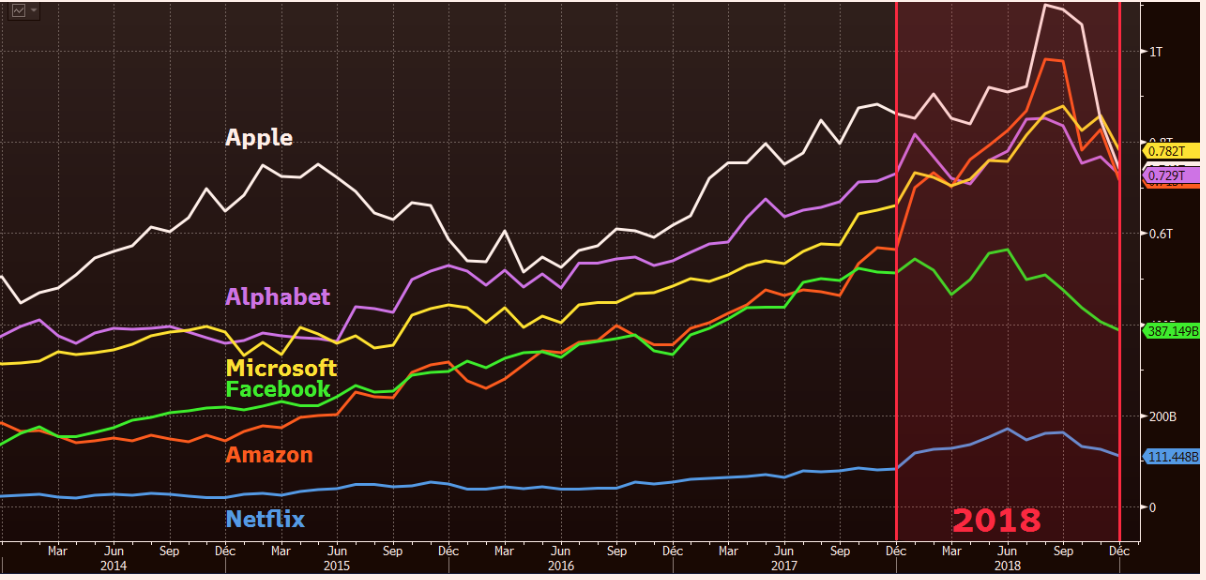

US: the Nasdaq 100, closing slightly in negative, will not have made its ten consecutive years of increases. Indeed, since 2009, the technology stock index has been making history by accumulating gains like never before. During this period of euphoria but also of considerable technological progress, the GAFAs symbolize this historic period. The last annual sequence saw divergent paths for Alphabet (-2.5%), Apple (-13%), Amazon (+25%) and Microsoft (+18%). The Redmond company has achieved its 6th consecutive year of growth, a track record that has been rewarded by the world's leading company in terms of capitalisation. Netflix (+33%) completes the list of winners, a performance that finally validates its earnings power, while Facebook (-23%) seems to date to be the most vulnerable company in this restricted clan.

Among the components of the Dow Jones Industrial, defensive stocks dominate the rankings, including Merck with its +34%. This increase comes after 4 years of lateralisation of the pharmaceutical company's share price. On the other hand, Goldman Sachs is the one to close the gap by cashing in a violent -35%, the investment bank being bogged down in a scandal with Malaysia over a sovereign fund.

Long dominated by Apple, the New Technology Giants are fighting hard to position themselves as the world's leading capitalization. Microsoft has just regained the first symbolic rank. Volatility is expected to continue into the new year, which could upset this honorary ranking.

DAX: German stocks, most of which are exporters, have suffered terribly from frictions in world trade. The Frankfurt index lost 18% over the twelve months. Five stocks out of the 30 members have nevertheless recorded a winning run and the first place goes to Wirecard with its 42%, a real achievement in the current stock market environment, even if the stock reached its peak at the beginning of October when the performance was at 75%. The banking sector is duplicating the global sector with a 56% drop for Deutsche Bank, which is caught up in disputes and restructuring that is taking a long time to bear fruit. In the same order of degradation, Bayer fell by 40%, the chemical giant was affected by the conviction of its subsidiary Monsanto on the dangerousness of Roundup.

The German company posted the worst performance of the EuroStoxx 50, unlike Nokia, which climbed 27% in the same European index.

CAC40: the index fell by more than 12% (first decline since 2011). A quarter of its components are still on a positive path. The list of the strongest increases includes Safran +19%, Dassault Systèmes +14.6% and Peugeot +8%. This last performance contrasts with Renault's, which remains strongly affected by the recent setbacks of its President (-35%). The year will also be very painful for the shareholders of Valeo, the fallen star, since after 6 years in the green, the equipment manufacturer is collapsing by 60%, a real crash that wipes out the last four years of growth. Banks are not immune to the general slump even if their financial health remains intact, BNP Paribas and Société Générale are down 35%, placing these banking entities at historically low valuation levels and therefore producing returns of between 7 and 9%.

By

By