Block 1: Essential news

Bitcoin: the Halving has taken place

On April 19-20, 2024, the 4th halving took place on block 840,000. Henceforth, whereas around 900 bitcoins had been distributed to miners every day (6.25 BTC per block - i.e. approximately every 10 minutes) since 2020, it is now around 450 bitcoins that will be issued every day (3.125 BTC per block) until the next halving, in 2028. Historically, in the months following this event, as in 2012, 2016 and 2020, the price of the digital currency literally soared to new records. Will this phenomenon be repeated? Only time will tell.

36 months in prison for Changpeng Zhao?

Changpeng Zhao, founder of Binance, could receive a 36-month prison sentence following charges of violating anti-money laundering laws in the USA, with a fine of over $4.3 billion paid by Binance. Sentencing will take place on April 30, after Zhao, who pleaded guilty, posted $175 million bail to remain free. Prosecutors are recommending a 36-month sentence, underlining the seriousness of Zhao's offenses. Answer at the end of the month.

EY expands on Ethereum

Ernst & Young (EY), one of the Big Four in auditing, has launched its new commercial contracts platform, OpsChain Contract Manager (OCM), using the public Ethereum blockchain. The platform aims, according to the company, to manage commercial contracts with customers more efficiently, while reducing costs by 40% and improving time efficiency by 90%. Thanks to zero-knowledge confidentiality technology, EY intends to offer its services at a fraction of the initial cost, while guaranteeing scalability and neutrality on an open platform.

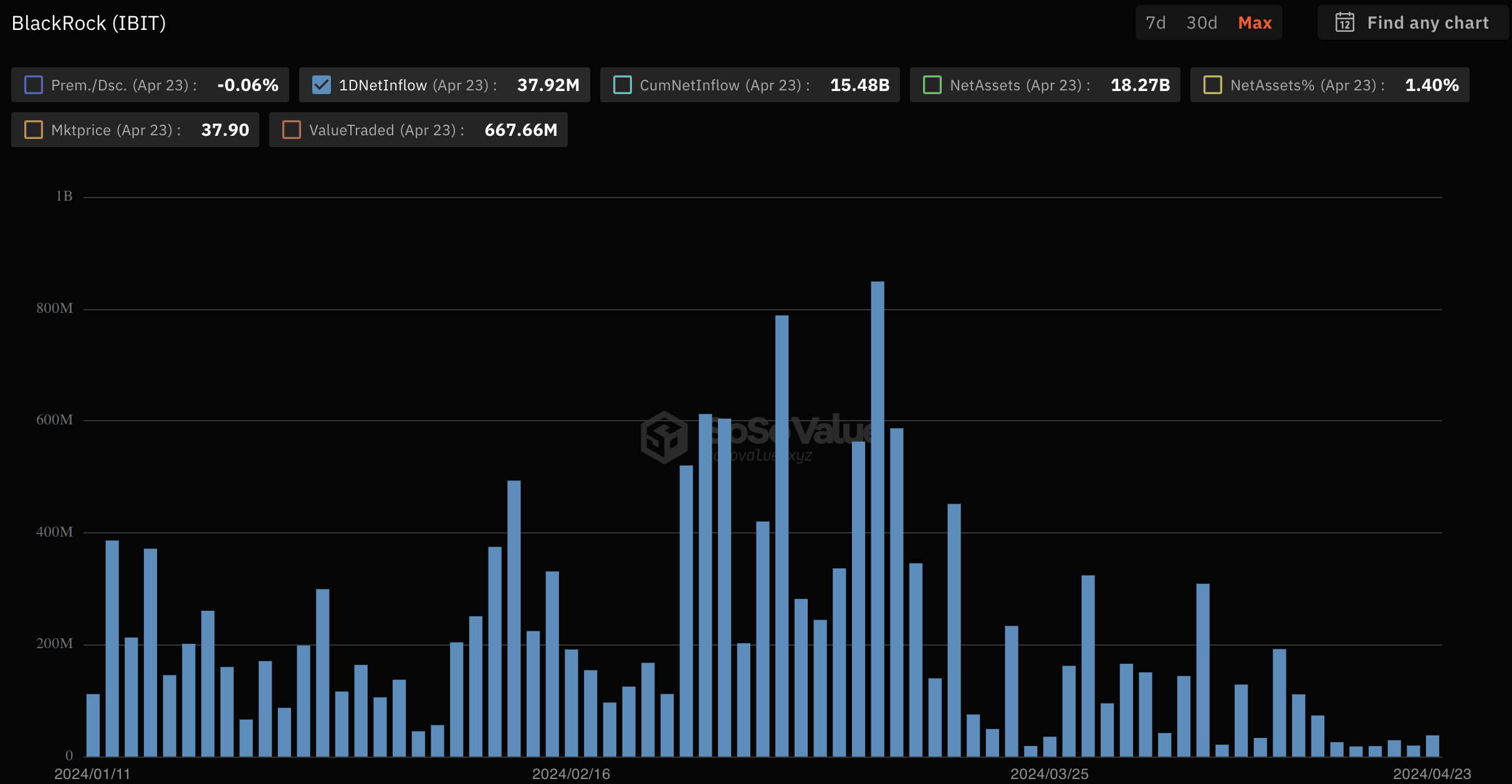

BlackRock: IBIT Bitcoin Spot ETF makes it into the Top 10

Since its approval by the SEC on January 11, 2024, BlackRock's Bitcoin Spot ETF, IBIT, has captured 70 consecutive days of net positive volumes of over $17 billion, equivalent to more than 270,000 BTC. This ETF ranks among the 10 best ETF performances in history, just behind leaders such as the US Cash Cows 100 ETF and the J.P. Morgan Efficient Economy. Despite these impressive results, IBIT has yet to surpass GBTC in terms of assets under management. In parallel, BlackRock is planning to enter the Ether (Ethereum) market with an application for a Spot ETF on this cryptocurrency, but for the time being no timetable has been set.

SoSo Value

Block 2: Crypto Analysis of the week

Stablecoins are cryptocurrencies designed to offer stable value, usually anchored by fiat currencies or a basket of assets.

Typically, in USDT for example - the leading stablecoin in terms of valuation - USDT tokens are created when users and businesses deposit dollars on their cryptocurrency platform in exchange for USDT. The 1:1 ratio of this asset is therefore created by exchanging US dollars for USDT. Conversely, when USDTs are deposited in exchange for US dollars, the USDTs are "burned" to ensure that the number of USDTs in circulation matches the amount of fiat currency on hand at all times.

The stablecoin market is considerable, with a valuation of around $157 billion. And there are good institutional reasons for this valuation.

Stablecoins open up the market trading window 24 hours a day, 7 days a week, 365 days a year - with no closures on public holidays and weekends. These cryptocurrencies are also particularly popular for settlement processes, cash management and facilitating cross-border payments in institutional finance.

These advantages mean that, today, the subject of stablecoins is often the most important topic in the crypto sphere for corporates and financial institutions. The possibility of making an international transfer of 500,000, 1 million or 10 million euros, on a Saturday evening at 11.30pm, in 5 seconds and at a cost of 5 euros, is often more attractive than the traditional alternative, which is generally much more expensive and time-consuming.

And interest is not confined to crypto startups.

JP Morgan's in-house stablecoin, JPM Coin, which is backed by certificates of deposit, handles internal payments and settlements, processing over a billion dollars a day and saving $20 million in repo transactions in 2023 alone.

Similarly, Société Générale has launched a euro-denominated stablecoin, which is traded on a public blockchain and the BitStamp platform. PayPal, meanwhile, has introduced its stablecoin, PUSD, to its vast user base of 435 million, supporting bitcoin conversions and retail payments, and plans to expand soon to cross-border payments.

Regulators are therefore rushing to look into the matter. Legislative moves in the United States aim to regulate stablecoins by imposing a strict 1-1 financial guarantee and banning algorithmic stablecoins to prevent a repeat of the UST scenario, which caused investors to lose $40 billion.

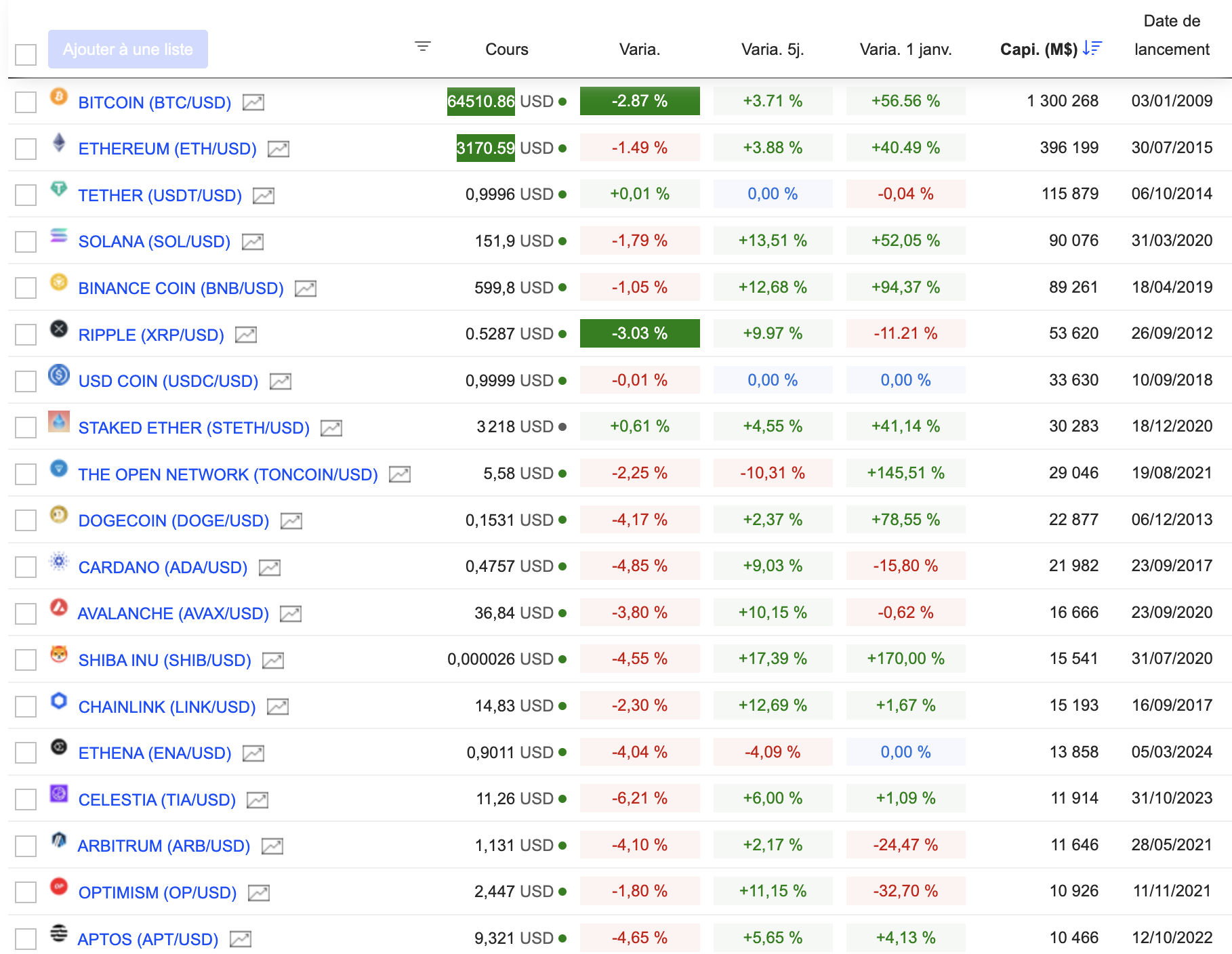

Block 3: Gainers & Losers

Crypto chart (Click to enlarge)

Block 4: Readings of the week

Bitcoin miners prepare for halving and race to cash in (Wired)

Bitcoin halves again - what does this mean for the cryptocurrency and the market? (The Conversation).

A rant against Ordinals (Bitcoin Magazine)

By

By