Quantzig, a leading analytics advisory firm that delivers customized analytics solutions, has announced the completion of their article on the benefits of sentiment analysis datasets for companies in the insurance industry. This article gives a clear understanding of how sentiment analysis datasets can address rising uncertainties in the insurance industry. It also analyzes the impact that a sentiment analysis dataset can have on the business and the ways through which it can manage risks efficiently to maximize ROIs for businesses.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190122005578/en/

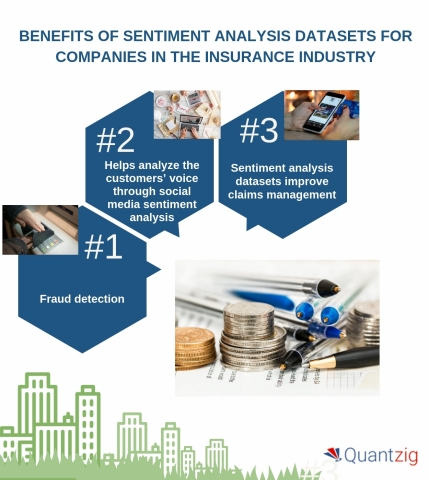

Benefits of sentiment analysis datasets for companies in the insurance industry (Graphic: Business Wire)

With rising uncertainities in the insurance industry, the challenges for insurers have also increased. Recent industry trends and regulatory changes such as Brexit and GDPR, the growth of autonomous devices, rising threat of cyber-attacks, and changing consumer behavior patterns are posing numerous challenges for companies. All such challenges are going to compel companies to emphasize on their customer services, not just in the terms of chatbots and online portals but in every aspect of their operational work. This will require insurance companies to leverag sentiment analysis datasets and customer analytics solutions to enhance the customer experience they provide.

Are you finding difficulties managing complex portfolios and customer relationships? Get in touch with our experts and know how our portfolio of customer analytics solutions can help you address such problems.

Benefits of sentiment analysis datasets for companies in the insurance industry:

Fraud detection

With the loss of millions of euros per year due to fraudulent reasons, companies in the insurance industry are compelled to analyze patterns in insurance claims and settlement notes to avoid compensations due to frauds. They need to leverage predictive analytic tools to develop a sentiment analysis dataset that can make proper use of KPIs (Key Performance Indicators) and help them make well-informed decisions. This decreases the chances of fraudulent claims and aids insurance companies with better profits.

Want to achieve better savings by restricting the number of false claims? Request a free proposal and know how we can help you boost profits by decreasing fraudulent claims.

Helps analyze the customers’ voice through social media sentiment analysis

Changing times have made it mandatory for companies in the insurance industry to leverage social networks and satisfaction surveys to understand the requirements of their customers. Companies are leveraging automatic opinion and social media sentiment analysis datasets to identify the polarity of specific aspects or issues of a channel, product, or procedure. Moreover, they can be employed to identify industry trends, analyze the brand perception, and gain information regarding reputational crises beforehand.

Wondering how to leverage social networks and analyze the changing trends of the insurance industry? Request for more information.

Sentiment analysis datasets improve claims management

Sentiment analysis datasets can be effectively utilized by insurance companies to classify complaints according to the products, services, or operations as it eases out the claim management process for customers and companies and ensures that customers receive timely responses. Moreover, they reduce the pressure of customer service centers and help in identifying fraud and fraudulent customers. Companies can even leverage social media sentiment analysis datasets to enhance customer experience, improve improvs client recommendations and retention, gain a market overview, and reduce indirect costs.

Are you suffering heavy losses due to false insurance claims? Request a free demo and know how sentiment analysis can improve the claims management process for your company.

About Quantzig

Quantzig is a global analytics and advisory firm with offices in the US, UK, Canada, China, and India. For more than 15 years, we have assisted our clients across the globe with end-to-end data modeling capabilities to leverage analytics for prudent decision making. Today, our firm consists of 120+ clients, including 45 Fortune 500 companies. For more information on our engagement policies and pricing plans, visit: https://www.quantzig.com/request-for-proposal

View source version on businesswire.com: https://www.businesswire.com/news/home/20190122005578/en/