What’s inside:

- Nasdaq 100 takes leadership in recent trade

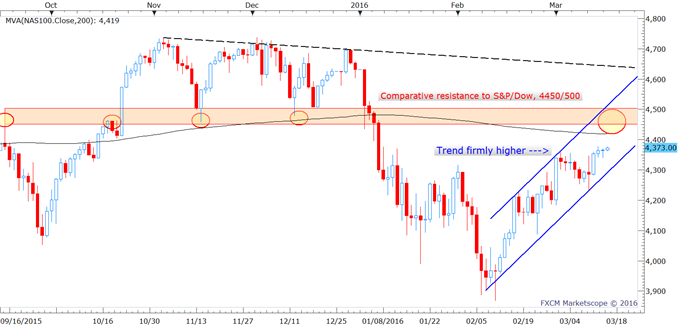

- Short-term top-side objective between 4450 and 4500

- FOMC today, not ideal for new long positions

Nasdaq takes lead

The Nasdaq 100 has been a laggard behind the S&P 500 and Dow for much of the ascent off the Feb 11 low, but for about the past week this dynamic has changed, with a rotation into bellwether tech stocks and the likes of Apple (AAPL) and Google (GOOG) paving the way. The S&P and Dow both cleared critical resistance levels to conclude last week, while the Nasdaq on the other hand had yet to even reach its respective levels of resistance, but that should soon change. The area we are talking about is the 4450/4500 vicinity if we compare to 1990/2010, S&P 500; Dow 16900/17100.

S&P 500 is king, however...

Generally speaking the S&P is regarded as king when it comes to analyzing and trading the broad market, while the other indices – NASDAQ, Dow, Russell 2000, etc. – are viewed secondarily and comparatively. However...

Moving forward the better index to look for long set-ups until top-side objectives are met (if they are to be met) may be the Nasdaq 100. On continued strength we will watch the 200-day at 4420 and, more importantly, price resistance between 4450 and 4500.

Nasdaq 100 Daily: Sep '15 - Present

FOMC today, not ideal for new positions

Later today the FOMC will announce its rate decision (no change expected), release its policy statement, and hold a press conference. This doesn’t make for very ideal conditions for entering into new positions, but once the Fed passes and the dust settles, we will see how the indices fared and watch for signs the Nasdaq 100 will continue to take the reigns it grabbed in recent trade.

Want to become a better trader? Of course you do, check out this guide - 'Traits of Successful Traders'.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter @PaulRobinsonFX, or email him directly at probinson@fxcm.com

original source