- 👉Poland still outperforms in Europe

- 👉Smaller American companies remain docked, but...

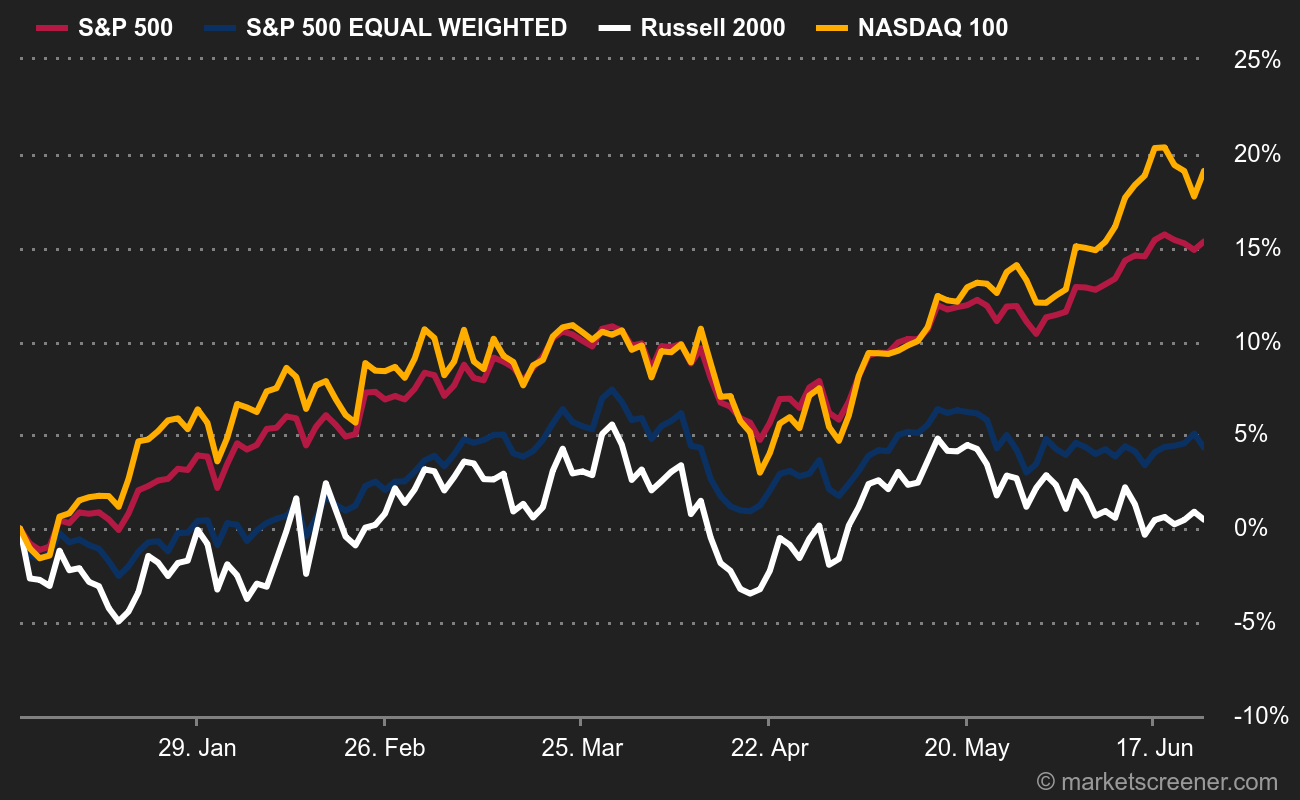

- Here's the chart of the quartet in 2024: despite the downturn of the last three days, the Nasdaq 100 dominates proceedings, while the Russell 2000 is depressed.

- An even more marked trend over 10 years, even though all four indices have brought investors gains.

- One swallow doesn't make a spring, but in the space of a week, investors have changed their tune a little.

Poland still outperforms Europe

Since the privatization of the Warsaw Stock Exchange in 2010, the WIG Index, Poland's main market index, has made considerable progress. After a bearish slide in 2022 following the war in Ukraine, the index price has been on an upward trajectory since 2023, reaching its all-time high in May.

At a time when doubts are gripping stock markets further west, Central Europe's industrial anchor is doing well and now boasts a market capitalization of $400 billion, with over 400 listed companies. This ranks the Polish stock exchange 6th in Europe in terms of the number of listed companies. The centrist party's victory in the European elections seems to have been favorably received by the market, as evidenced by the WIG's outperformance of the Stoxx Europe 600. Poland is attracting a great deal of interest from investors, thanks to its economic dynamism and its scope for progress in relation to the region's more mature economies.

WIG of change, as Scorpion would say (share price since the beginning of June)

Year-on-year, the Polish market also outperforms

Performance of the WIG Index (NB: the zloty has fluctuated relatively little against the euro over the last ten years, making the WIG's performance fairly comparable to that of eurozone markets).

- Current year: 12

- 1 year: 32.6% %.

- 10 years: 66.2% %.

American small caps still docked, but...

Will the movement in favor of value stocks against growth stocks over the past few days help to rebalance the debate between the Nasdaq and the rest of the US stock market? It's hard to say. In any case, the disparity in performance remains high in the USA, between four of the indices most closely followed by the market:

- The S&P500, Wall Street's most closely followed index, with a heavy weighting of technology stocks.

- The Nasdaq 100, Wall Street's best-performing index in recent years, with a majority of technology stocks and a high degree of inbreeding with the S&P500 for large-cap stocks.

- The Dow Jones, Wall Street's oldest index, with just 30 stocks whose weighting depends on price rather than capitalization, making it much less dependent on technology.

- The Russell 2000, which includes only small and medium-sized companies.

Here's the chart of the quartet in 2024: despite the downturn of the last three days, the Nasdaq 100 dominates the debate, while the Russell 2000 is depressed:

An even more pronounced trend over 10 years, even though all four indices have brought investors gains:

One swallow doesn't make a spring, but over one week, investors changed their tune a little:

By

By