Lately, the malaise of the Dow Jones Transportation Average (affectionately dubbed DJTA) has prompted some analysts to turn their attention to what could be a special situation, understanding a sector to watch for a hypothetical turnaround.

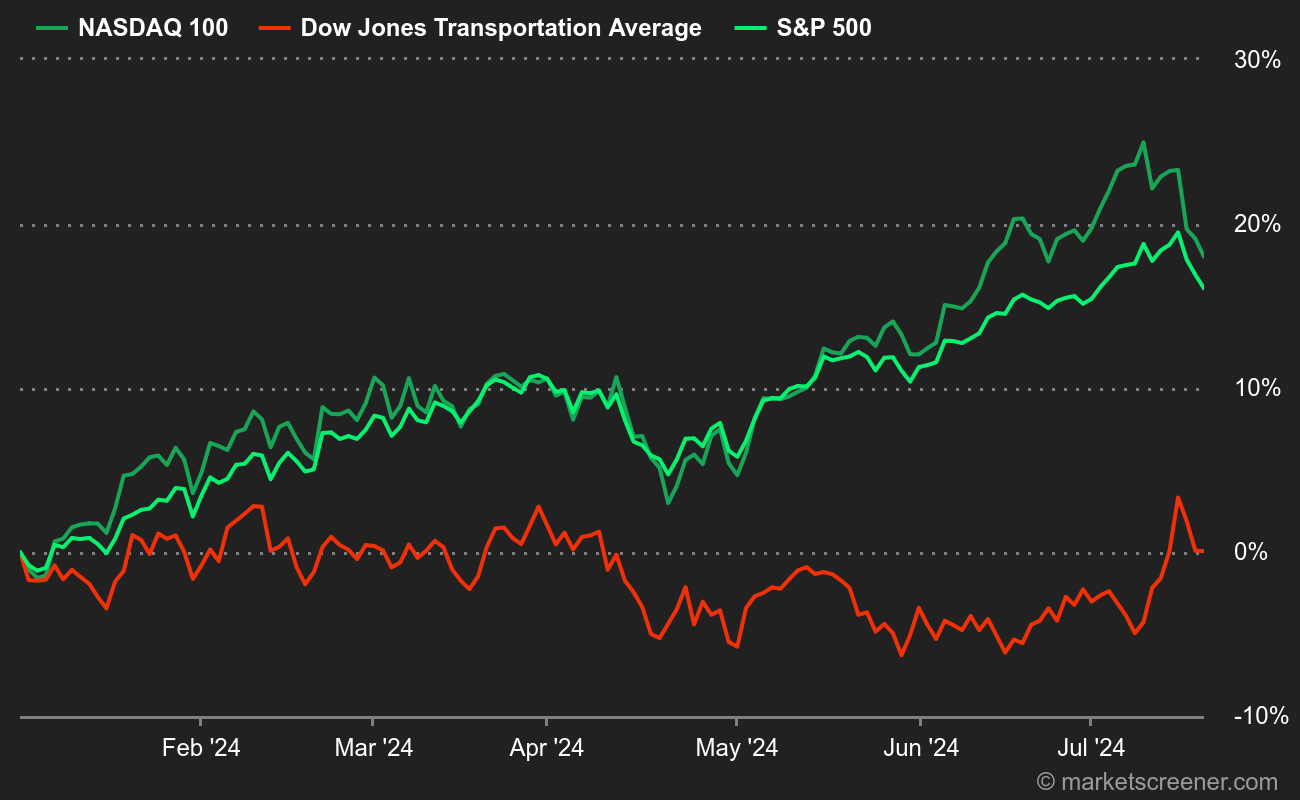

The DJTA has lost around 5% since the start of the year, in contrast to the 9% rise in the benchmark S&P 500 index in the USA. This index is made up of 20 stocks: rail operators, airlines, parcel carriers and trucking companies.

Given their characteristics, we can easily conclude that these stocks are good barometers of economic dynamics. The index that groups them together even more so.

Investors still haven't decided whether to opt for a soft or hard landing, but one thing is certain: they're not that keen on these capital-intensive stocks. They largely prefer large technology companies, which have proven their ability to evolve in changing environments.

Since the beginning of the year, Avis Budget has lost 37%, JB Hunt is down 21% and American Airlines is down 17%. Only 4 of the 20 components have outperformed the S&P 500 since the start of the year. Here's what it looks like graphically:

Before we talk about a transportation sector that's doing better, let's take a look at MarketScreener cultural and stock market center. Do you know why the DJTA exists? We have to go back to the 19th century, when Charles Dow, the father of the American stock market, created the famous stock market indices that bear his name. Back then, transportation was a bit like today's technology. Railroad companies made and broke fortunes. Hence the creation of the DJTA. At the same time, Dow also created the DJUA, which included utilities (water, electricity, etc.), which were also central at the time. Other industries were grouped together in the DJIA (Dow Jones Industrial Average). 140 years later, the DJIA is one of Wall Street's three benchmark indices, alongside the S&P500 and Nasdaq. But it still doesn't include transportation or utility values, which are confined to the DJTA and DJUA.

Oh my boat!

In the transport family, I ask for boats. Since tensions in the Red Sea forced freighters to go off on a tangent, prices have been on the rise again. Here's a model based on Freightos data. We can clearly see that the situation deteriorated from November onwards. Prices did not return to their incredible levels of the pandemic, but they clearly exceeded their previous averages.

Against this backdrop, the stars of the sector are rebuilding their margins, and stock prices are benefiting. This morning, AP Moller Maersk even raised its 2024 Ebitda forecast for the second time in a month, from $4 to $6 billion to $7 to $9 billion. The consensus, positioned at $6.1 billion, should be readjusted. The Dane's free cash flow is now expected to be $1 billion, whereas it had previously feared cash consumption of $2 billion. These figures suffice to show that the shipping business is extremely cyclical. The Group had been generating etic margins in previous years, before it started to make incredible profits in 2021 and 2022.

By

By