|

|

| This week's gainers and losers |

TOP: Applovin (+17%): The young American tech company announced a net profit for the first quarter, a turnaround from the net loss it reported last year, driven by higher revenues. Gen Digital (+17%): The internet security specialist announced better-than-expected results for the fourth fiscal quarter. The company reported non-GAAP earnings of $0.53 per diluted share on Thursday, up from $0.46 the previous year; analysts had anticipated $0.52. Constellation Energy (+16%): Constellation Energy, a giant in clean electricity production, exceeded analysts' earnings forecasts for the first quarter. This increase was mainly due to higher nuclear energy production and tax credits from the Inflation Reduction Act. The CEO announced the possibility of increasing the company's production capacity by up to 1,000 megawatts through improvements at its nuclear plants. Equinix (+11%): Equinix, a global leader in data processing, saw its shares climb after reporting adjusted operating profits and revenues for the first quarter that far exceeded Wall Street expectations. However, the company lowered its forecast for annual revenue from between $8.69 billion and $8.79 billion to between $8.79 billion and $8.89 billion previously expected. FLOP: Walt Disney (-8%): Mickey Mouse surprised investors with an unexpected quarterly profit for Disney+, its streaming division. However, a decline in television and film activities and cautious forecasts for the third quarter weighed on the stock price. Airbnb (-8%): Although the company reported better-than-expected results for the first quarter, thanks to particularly strong travel demand during the Easter period, the accommodation rental platform provided weak forecasts for the upcoming summer. Shopify (-13%): The online commerce platform saw its shares fall despite better-than-expected results for the first quarter. Investors were disappointed by the announcement of an expected slowdown in sales growth and a deterioration in margins in the second quarter. Palantir (-13%): Palantir raised its revenue and profit forecasts for the year due to strong demand for its artificial intelligence services. However, these figures did not meet analysts' expectations. Roblox (-18%): The popular online gaming platform saw its stock decline after it lowered its revenue forecast for the year 2024. Epam Systems (-24%): Epam Systems experienced the sharpest drop among companies listed in the S&P 500. The company saw its shares plummet after disappointing results for the first quarter. The firm, which offers a wide range of software services, had to contend with a significant drop in both profit and revenue. More worryingly, Epam also lowered its revenue forecasts for the entire year. |

|

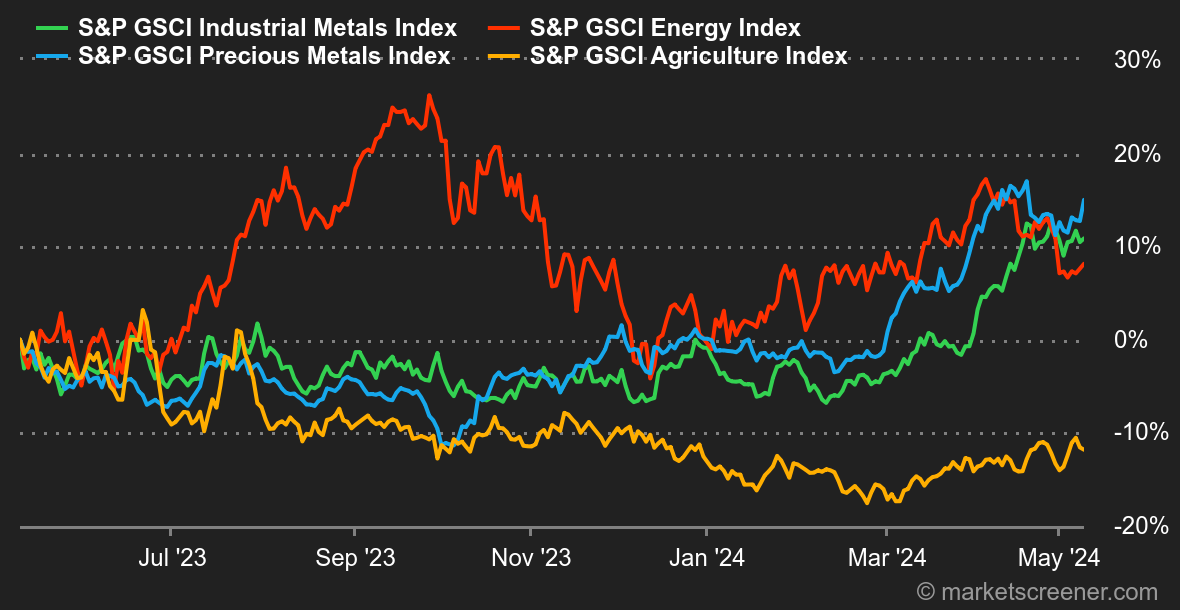

| Commodities |

Energy: Oil prices have rebounded this week, although the increase has been a struggle. Brent crude even briefly dropped to $81.70 USD, a price movement triggered by statements from Russian Deputy Prime Minister Alexander Novak, who hinted that OPEC+ might increase its production. This assertion, quickly denied, is surprising since it is highly likely that the extended organization will maintain its production quotas, which currently stand at 2.2 million barrels per day, given the weak oil prices. In other news, US inventories have decreased again this week, and the US Department of Energy still estimates that the US will produce 13.2 million barrels per day this year. In terms of prices, Brent is trading slightly higher at around $84 USD while WTI is trading around $79.51 USD. Metals: The price of copper is rising in London. China plays a significant role as the Asian giant has released strong trade data for April. Spot copper is thus trading at $9900 USD on the London Metal Exchange. In the precious metals sector, the price of gold has resumed its upward trajectory, reaching $2360 USD per ounce. Agricultural Products: Following the cocoa market is not for the faint-hearted, as prices have been extremely volatile. Prices, which had dropped more than 30% in just two weeks, have recovered about 10% in five days. Yet, fundamentally, nothing has really changed: the outlook for global supply remains gloomy, which will lead to a significant deficit this year. In Chicago, wheat prices are gaining ground at 640 cents per bushel, while corn prices are stagnant at 460 cents. |

|

| Macroeconomics |

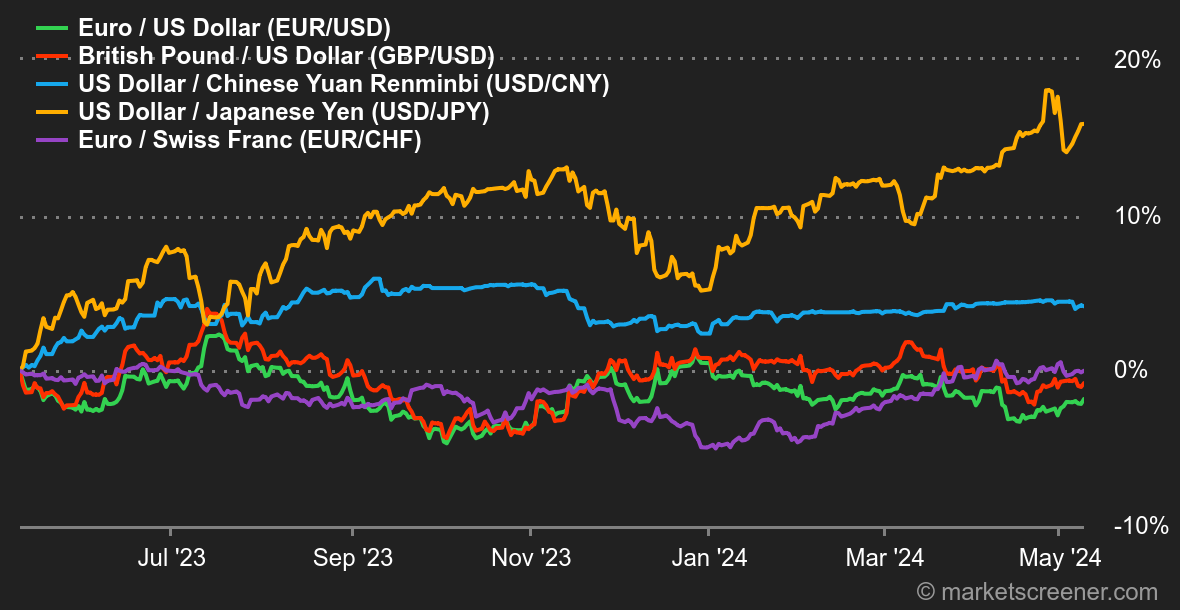

Atmosphere: Europa First. Unusually, it was the Bank of England that led the way this week, paving the path for a more relaxed monetary policy. The May meeting ended with a status quo on rates, but the tone was less austere than before. The rest of Europe quickly took this as a positive signal for an initial rate cut by the ECB in June. If the bookmakers are right, both the BOE and the ECB will embark on easing policies before the Fed, which is still somewhat entangled in persistent inflation. A few weeks ago, investors believed that the US central bank would be the first to act. This hasn't stopped the market from being less pessimistic about the Fed's maneuvering room than it was in April. A series of poor indicators recently published in the United States has revived expectations for a rate cut in September - sooner than previously thought. This situation has pushed the dollar down to 1.078 against the euro. Gold has taken advantage of this to wake up ($2372 per ounce). The yield on 10-year US debt has fallen to 4.45%, while the 2-year moves away from the 5% mark. In Europe, the Bund ended the week at 2.46% and the OAT at 2.94%. Crypto: Bitcoin has struggled to find an upward path for over a month. April was particularly painful with a 15% decrease in its valuation - a counterperformance that contrasts with the seven consecutive months of gains from September 2023 to March 2024, during which the digital currency soared from $25,000 to $71,000, a rise of more than 170%. This movement was mainly driven by the marketing of Bitcoin Spot ETFs at the beginning of the year across the Atlantic. But the enthusiasm seems to be fading. Currently, BTC is trading around $63,000, about $10,000 below its all-time high reached last March. Meanwhile, ether (ETH) remains stable around $3,000 this week. The second-largest cryptocurrency by market capitalization has still not returned to its previous all-time highs from late 2021, around $4,800. It’s been a positive week for Solana (SOL), which has gained more than 20%, trading around $154, thanks in part to a growing influx of users on network applications, which directly impacts the digital currency. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By